Posts

Fixation in 7cpc example

साथियों नमस्कार

बहुत से साथी शंका में हैं की उनका फिक्सेशन किस तरह किया जायेगा

इसके समाधान हेतु एक उदाहरण दिया जा रहा है –

(नोट- ये साथी HRA नहीं लेते हैं)

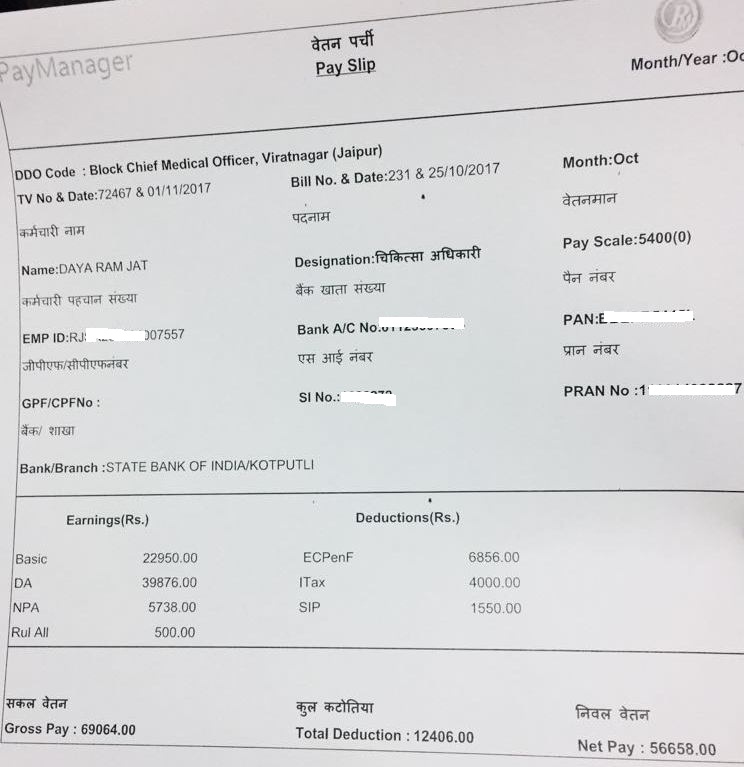

6th वेतनमान का बिल –

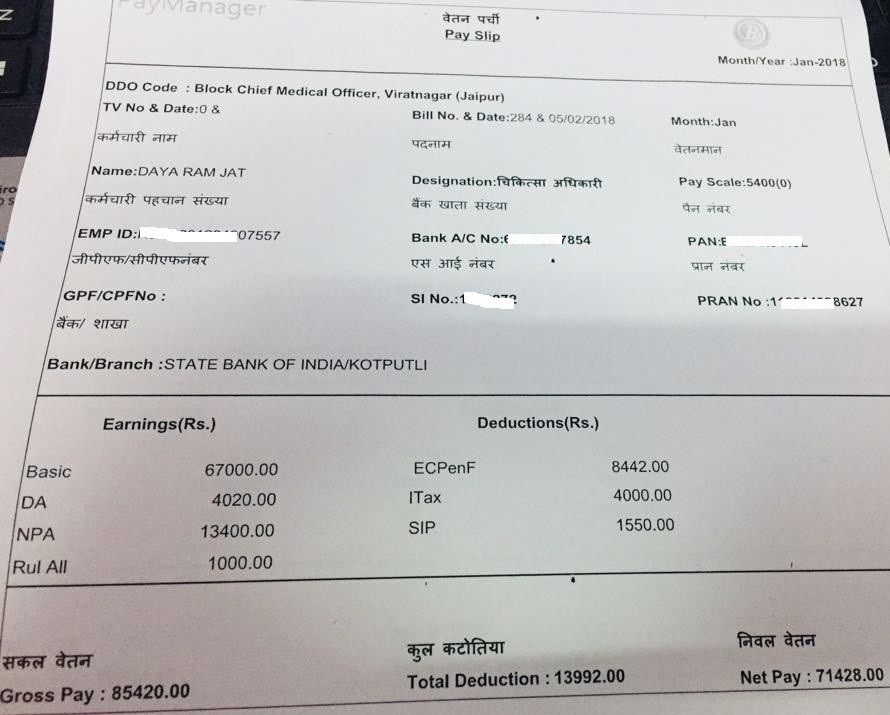

7th वेतनमान का बिल –

इस तरफ से आपका वेतनमान बदला जायेगा 🙂

आपका वेतन कितना बनेगा यह जानने के लिए यहाँ जावें – CLICK HERE

Punjab Cabinet paves way for MBBS Doctors to get full pay during Probation Period

Chandigarh, March 19, 2018: In a bid to retain talent and overcome shortage of medical staff, the Punjab cabinet on Monday decided that MBBS doctors will now get their full salaries, including all allowances, during probation period.

With this, the Cabinet, led by Chief Minister Captain Amarinder Singh, has decided to do away with the condition of ‘basic pay only’ for newly appointed medical officers in the Health & Family Welfare Department.

This is in line with the practice already being followed in several other categories, including Punjab Civil Services (Judicial Branch), Assistant Teachers/Scientists of Punjab Agriculture University and Specialist Doctors, said an official spokesperson.

Barring these categories, all newly appointed employees/officers of Punjab Government, including MBBS doctors, have been getting only basic salary during their probation period, as per the notification issued by the Finance Department on January 15, 2015.

In the case of doctors, specialist doctors recruited along with Medical Officers (MBBS) are getting full pay including all the allowances on the basis of relaxation given to Medical Officers (Specialists), whereas MBBS doctors are getting only basic pay and NPA @ 25% of Basic Pay. This has proved to be a deterrent in getting MBBS doctors to join or remain in government hospitals.

The cabinet decision would facilitate new MBBS doctors to get full salary in the pay scale of Rs.15600-39100+5400/- Grade. Pertinently, the Punjab Public Service Commission had issued an advertisement on February 21, 2018 for recruitment of 306 posts of Medical Officers (General) in the Health and Family Welfare Department to overcome the shortage of doctors in Government Hospitals and Dispensaries across the state.

It is noteworthy that Medical Officers are also working on Medico-legal, Post Mortem, emergency duties, OPD duties, besides the Health Programmes of Central Government and State Government and also the VVIP duties in addition to their services to the general public. Due to acute shortage of doctors, the department is facing difficulties in providing 24X7 hours services to the members of the public.

The Punjab Vidhan Sabha Assurance Committee had also taken serious note of this shortage and directed the Government to fill up these vacant posts at the earliest. In the light of this, the proposal for the payment of full salary to the newly appointed MBBS doctors (being professional), equal to the pay being given to the Specialist doctors, was put up before the Chief Minister after approval by the Health Minister.

In another decision, the Cabinet also approved the “Punjab Health and Family Welfare, Technical (Group-B) Service Rules-2018” to facilitate recruitment and promotions of various technical group “B” vacant posts. These rules would also open more promotional channels for the para-medical and technical staff of the Health and Family Welfare. Additionally, they would help in disposing of the pending service matters smoothly and efficiently, in a stipulated timeframe, besides providing the best healthcare services to the citizens.

Contributory pension Scheme (NPS/CPF)

The government has fixed 10% of the Basic Pay+ Grade Pay+ Dearness Allowance+ NPA, as the mandatory amount of contribution to the Scheme. No excess or lesser amount should be

deducted from the salary. It is the responsibility of the DDOs, for the correctness of the deduction. If, say, the total of BP+GP+DA is Rs 13410, than only 1341/ (@10% of 13410/-) should be deducted from the salary.

For any deviation, in the deduction, the DDO concerned would be held responsible.

The eligible state government employee shall commence contribution to CPS, after allotment of CPS account no. by this office, from the first month of joining the government service, as ‘Arrear’. This will also be deducted @ 10% of the BP+GP+DA, of the particular month. months are due, starting from the month of joining CPS, to the month of ‘First contribution’ is made by the DDO, after getting the CPS INDEX NUMBER.

Illustration: If month of joining is January, 2007 and month of first deduction, after getting CPS INDEX NUMBER, is January, 2009, the total arrear months are 24, and arrear has to be deducted as 1/24 in January, 2009, 2/24 in February, 2009, 3/24 in March, 2009…..up to 24/24 in Dec, 2010.

This amount has to be shown separately, as ‘ARREAR’ along with current month’s CONTRIBUTION’. (I.e. one subscription for current month and one additional for subscription arrears).

For ‘Arrear’ contribution also, equivalent amount would be contributed by the employer.

Other arrears such as PC arrears or DA arrears should be deducted in the month of account and SHOWN SEPARATELY AS ‘OTHER ARREARS’ in instalments only.

Interest would be calculated at the prevailing rate applicable to GPF which is now at 8%.

Interest is given for current credits from the month of contribution. For arrear credit, interest is from the month of transaction, though arrear may relate to previous months.

Final payment procedure: At the time of retirement, the employee would be required to invest 40% of the pension wealth to purchase an annuity which will provide pension for life time to the employees and in the event of his death to his dependent parents/spouse.

The remaining 60% pension wealth would be paid to the employee at the time of his retirement to utilize in any manner.

CPF deduction shall not exceed an amount equal to 10% of his salary (includes Dearness Allowance but excludes all other allowance and perquisites).

The monthly contribution is 10 percent of the Pay and DA to be paid by the employee and matching contribution by the state Government. The contributions and returns thereon would be deposited in a non-withdrawable pension account.

CPF = 10% of (Basic Pay+DA+NPA)

Dearness Allowance DA

What is Dearness Allowance ?

Dearness Allowance is cost of living adjustment allowance which the government pays to the employees of the public sector as well as pensioners of the same. DA component of the salary is applicable to employees in India.

Dearness Allowance can be basically understood as a component of salary which is some fixed percentage of the basic salary, aimed at hedging the impact of inflation.

How to Calculate Dearness Allowance?

After the Second World War, DA component was introduced by the government. After 2006, the formula for calculating dearness allowance has changed and currently DA is calculated as follows,

For Central Government employees:

Dearness Allowance % = ((Average of AICPI (Base Year 2001=100) for the past 12 months -115.76)/115.76)*100

For Central public sector employees:

Dearness Allowance % = ((Average of AICPI (Base Year 2001=100) for the past 3 months -126.33)/126.33)*100

Where, AICPI stands for All-India Consumer Price Index.

From the year 1996, DA has been included to compensate for price rise or inflation in a particular financial year and hence it is revised twice every year, once in January and then in July.

What is Salary ?

!! Full Explanation of “SALARY” !!

Salary!

isn’t it every ones favorite? Its paid once in month & in 5 days or less fully expensed out.

We wait eagerly for whole month to receive the same. We work hard & with full efforts to earn this. When it is credited in bank a/c or received check or cash on pay day, see that smile on your face and specially your family.

Salary = Basic Pay + DA + NPA + HRA + TA + RA + WA – NPS – SI –HRD– TDS (Income Tax)

Components of Salary :

- Basic Pay

- Dearness Allowance

- Non Practising Allowance

- House Rent Allowance

- Travelling Allowance

- Rural Allowance

- Washing Allowance

- Contributory Pension Fund (NPS)

- State Insurance Premium

- House Rent Deduction

- Income Hai to Tax Hai

BASIC PAY –

Basic Pay = Pay in Pay Band + Grade Pay

Pay Band – 15600-39100 , Grade Pay – 5400

First Basic Pay = 15600+5400 = 21000

Increment – 3% of Basic pay every year (July)

If probation completes before 31st Dec.– 3% of Basic Pay will be added in NEXT July.

Tip – First increment will be added in Next year(July) of Probation completion year.

Example – If your probation is completing on any day of 2017 (1 January 2017 to 31 December 2017 ), you will get your first increment in July 2018.

Second Basic Pay = 3% of First Basic Pay+ First Basic Pay = 630+15600+5400 = 21630

Pay in Pay Band is increased from 15600 and becomes 16230.

Based on this basic pay all other allowance are calculated like Dearness Allowance (DA), House Rent Allowance (HRA), Non Practising Allowance (NPA) & Transport Allowance (TA).

How to check salary status –

<a href="/index.php?p=536">How to check salary status</a>